Consumer Duty’s Consumer Support Outcome – What does it mean and what are the opportunities it brings?

An interview with Neil Wake, CEO of Dialect

Consumer Duty regulation came into force in the UK in July 2023 for new and existing financial service products. In July this year we will see it applied to closed products or services. The Consumer Duty fourth outcome is something of a specialist area at Dialect and our CEO, Neil who brings vast experience in both sectors – Fintech and Customer Support.

Before we get into the nitty gritty Neil, what is the Fourth Outcome of Consumer Duty and what does it really mean?

The fourth outcome of the FCA (Financial Conduct Authority) Consumer Duty legislation requires Financial Firms to implement and design solutions to meet their customer’s needs in terms of access to support when they need, and in a format which best meets the customer needs. This includes provision and support for those who are vulnerable. It is important to remember the FCA say frequently “Consumer Duty is not a once and done exercise” this means the provision must be robust, durable and ongoing to ensure requirements are met.

At the core of Consumer Duty legislation is the previous directive on treating customers fairly (TCF) .If we take the tenant “support they need, when they need it” – How does this align with the regulations and refer back to Treating Customer’s fairly?

For many years our industry has thrived and grown on the development of technological solutions for customer problems. We must ensure that the support available across these solutions and services retains the core value of being customer centric and ensuring the ongoing needs of the customer are met.

Firms must ensure they have the right resources in place to support customers whether that customer is abroad on their holiday miles away, it is, Sunday morning or very late Saturday night. The customer must have access to necessary support and assistance.

To ensure optimum alignment with customer need a range of contact methods is suggested to ensure customer preference or overt requirement are met. Some customers may regularly use in app Chat and never dream of using phone to speak to someone, but some user demographics or vulnerable customers may prefer to speak to someone to offer more in person guidance and comfort.

Vulnerable customers are very varied and the FCA highlights within this area people for whom English is not their first language. Financial firms must consider this requirement for customers and provide multilingual solutions where needed to make sure customers are supported and treated fairly.

The key here is though, planning and application.

You mention multiple channels of contact there, why is it important to provide a wide range of methods of interaction for customers?

People are different – there are no 2 people the same.

Their queries and support needs may also be different. A question about what documents can be used to open an account can perhaps be managed by chat or email but very often we see a clear preference for voice contact when discussing account matters, balance issues or transaction queries. One channel of interaction won’t fit all customers.

Continued review of customer engagement – query types, channels used and customer satisfaction ensure ongoing tailoring and efficiency and come back to the FCA idea that Consumer Duty is not a once and done task. This is about ongoing and invested customer engagement.

Based on your experience at Dialect, your previous experience in Payments and the high level of best practice you see your partners engaging with their customers, what advice would you give to Payments businesses to meet Consumer Duty’s fourth outcome, consumer support?

Know your customers. Who are you looking to serve? What are their needs? How do you think they will communicate and what about?

Plan and review your customer journeys. New businesses need to look at customer experience of the solution offered and what this may throw up. Existing businesses should be actively reviewing customer journeys and ensuring they are optimal.

Meet your obligations to vulnerable customers. To be best in class do all you can to ensure all customers feel included, supported and visible.

Review your data. Work as a business or with a partner who will feed back information on customer experience to ensure it is always optimal and successful. Never leave it alone.

We have looked at the idea of Consumer Duty, some of the requirements and guidance on it, but what are the opportunities?

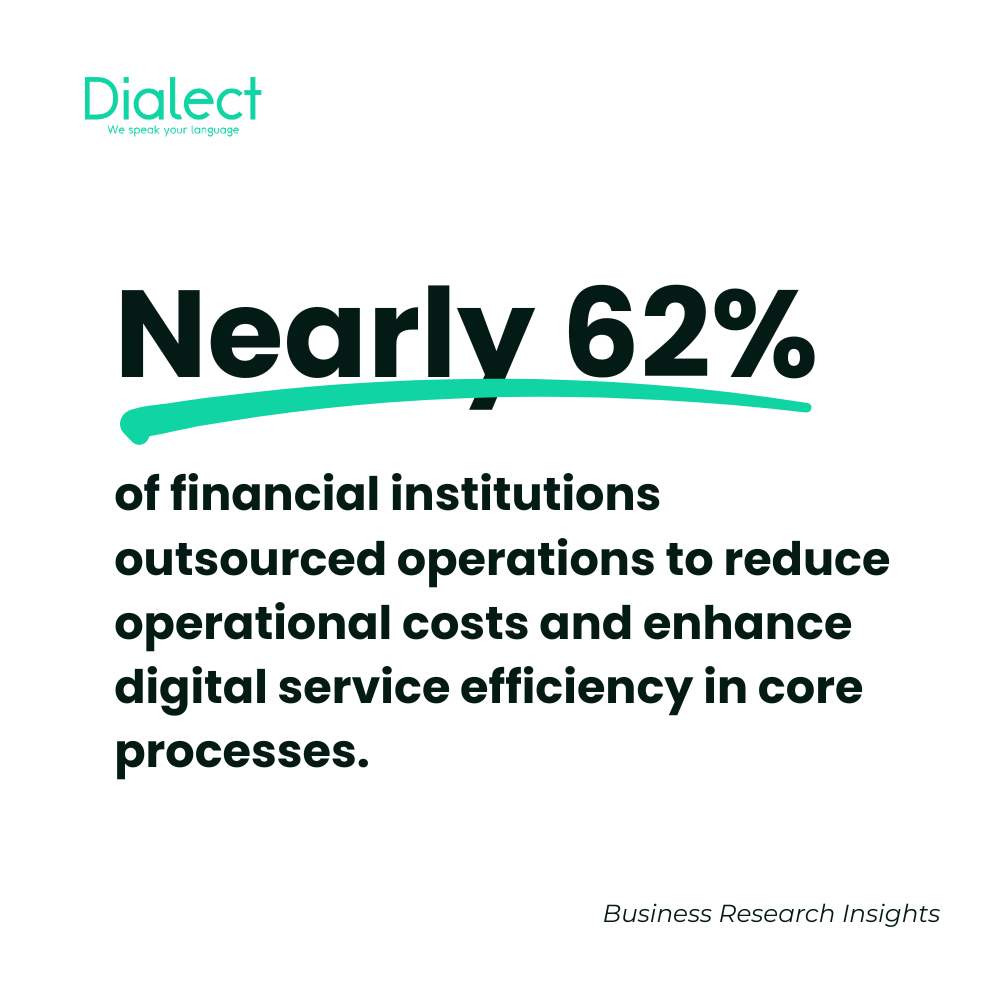

To be honest, the consumer sector is challenging. Increased regulation applies increased rigour which translates to time, effort and cost and the revenue side of the sector can be exacting, but if you as a business are able to get it right the opportunities are huge.

Some businesses have made strategic decisions to pull out of the sector due to these pressures but if you can build a solution that meets requirements the market is there.

Customer loyalty and advocacy cannot be underestimated and the value of retaining customers is clear.

As with every new regulatory development or change in our sector it often starts as a challenge but there will be opportunities created which some businesses will capitalize on.